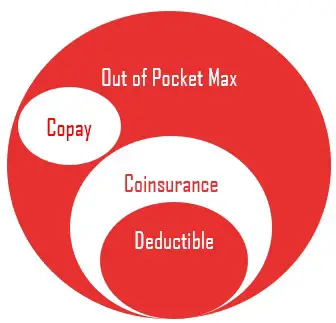

To fully understand how out-of-pocket expenses work, there are three additional terms to learn: deductibles, out-of-pocket maximums, and annual limits. In some cases, your plan might charge a copay for one type of service and coinsurance for another. Coinsurance: One Piece of the Out-of-Pocket PuzzleĬoinsurance and copays are what’s known as “out-of-pocket” expenses, meaning it’s something extra you have to pay when you receive health care, on top of your monthly premium. Let a licensed insurance agent help at no cost to you. Fortunately, you don’t have to do it alone. With coinsurance, you pay a percentage of the visit, so the higher the underlying bill, the more you’ll be required to pay.ĭeciding between these small differences can become confusing, and time consuming, when comparing health insurance plans’ copays and coinsurance percentages. With a copay, you know you will pay a set amount to see your doctor for any reason. The advantage of a copay is that it allows for greater predictability for the consumer, and they are generally more affordable. And, you might have a $10 copay at the pharmacy to pick up the prescribed medication. The trip to the specialist might require a copay of $30, regardless of the services that were provided. If you had a treatment that called for copays instead of coinsurance under your policy, you might be asked to pay a flat fee of $20 for the doctor visit, whether the doctor billed you for $100 or $300. Copays (or copayments) and coinsurance are very similar except for one key difference: While coinsurance is a percentage of the total cost, a copay is a flat fee. A licensed insurance agent can help you review your coinsurance options when you’re ready to shop for a new plan. Many plans are different and cover a different percentage of cost. While the equation may seem simple enough, it’s important to understand the terminology around coinsurance and what you’re obligated to pay under your insurance plan. The prescription costs $60, so you are asked to pay $12 out of pocket (20% of $60), and your insurance takes care of the remaining $48. The specialist prescribed you some medication for your eye, so you head to the pharmacy to pick it up. Your visit to the specialist cost $120 so you paid $24 (20% of $120), and your insurance company paid the remaining $96 of the bill.

#Copay after deductible full#

Scenario #2: Let’s say your primary care physician couldn’t provide the full treatment for your eye infection and had to refer you to an eye specialist. Scenario #1: If the examination by your doctor cost $100, you would pay $20 out of pocket while your insurance company would pick up the tab for the remaining $80. Let’s say you visit a doctor because you have an eye infection. Coinsurance can apply to office visits, special procedures, and medications. What Does 20% Coinsurance Mean?Ī 20% coinsurance means your insurance company will pay for 80% of the total cost of the service, and you are responsible for paying the remaining 20%. You typically pay coinsurance after meeting your annual deductible. Coinsurance is a form of cost-sharing, or splitting the cost of a service or medication between the insurance company and consumer. What Is Coinsurance and How Does It Work?Ĭoinsurance is what you-the patient-pay as your share toward a claim.

#Copay after deductible how to#

But chances are equally high that you don’t know exactly how to answer the question “what is coinsurance?”. If you’ve ever had health, dental, or vision insurance, chances are good that you’ve heard of coinsurance.

0 kommentar(er)

0 kommentar(er)